Phoenix recently ranked #1 in the nation for home improvement hobbies. Meaning, more than ever, people need a way to better track their projects for their newfound favorite hobby. Thankfully our house flipping spreadsheet makes it easy.

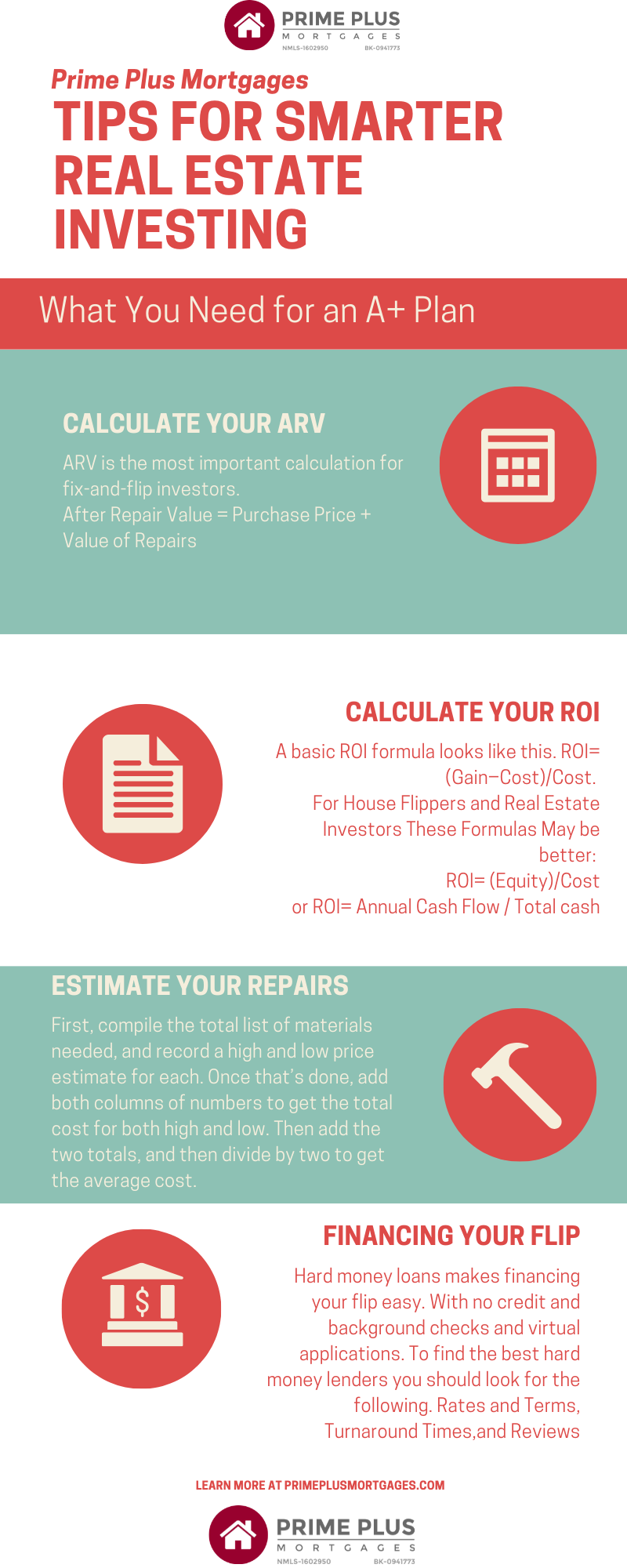

Whether you plan to sell, invest in property, or just need to budget your next repair, our house flipping spreadsheet can do it all! Here we outline top house flipper tricks to make the biggest returns in home value for your home, no matter the project. You can use the following infographic to help you use your spreadsheet to make better repairs for your property.

When using this spreadsheet it is important to know the key factors for your flips. We walk through your must-haves to smarter investing with a house flipping spreadsheet. Get our free home rehab valuator when you apply for a hard money loan!

Using Your House Flipping Spreadsheet To Calculate Your ARV

After repair value, or ARV is the most important calculation for fix-and-flip investors. Private money lenders use the after-repair value to calculate profit and future value for properties to determine loan values.

If you have purchased or sold a home, you are familiar with comps. Comps or comparable properties help determine a property’s current value. These comps can also be used to determine future value.

The following information is important when determining a property’s current value:

- Location (neighborhood, accessibility, proximity to amenities, etc)

- Lot (size, corner or interior, shape, slope, terrain, roads available, etc)

- Structure (size, number of stories, type, style, etc)

ARV, or after repair value is important because it determines a project’s sale price, renovation budget, and overall profits for the flippers. It is also used by investors looking to determine the value of a rental property after renovations to estimate rent and/or the future value of the long-term property.

ARV is essential to know how much you can earn from a real estate investment. To calculate the ARV of a property, the following you can apply the following formula.

After Repair Value Formula = Property Purchase Price + Value of Repairs.

For example, if the property’s purchase price is $100k, The repair cost is $25k, and you expect to sell it for $150,000, the value of repairs is $50k but the cost of repairs is only $25k. This results in an ARV of $150k and a potential profit of $25k.

If you don’t know how to value your repairs, You can find the ARV of a property by comparing other properties with similar renovations. This would mean seeing what repairs added to a higher value. For example, a home with a new roof would value higher than a home with a roof needing to be replaced. These small repairs can add up!

How To Use Your House Flipping Spreadsheet To Calculate Your ROI

ROI is a real estate investing term that can be extremely beneficial to new investors if used properly. ROI, or ‘Return On Investment’, simply means the percentage of invested money that’s recouped after the deduction of associated costs. That means how much do you earn off property for making repairs!

There are two methods you can use to determine your ROI, depending on how you finance or fund the property repair.

While the basic ROI formula looks like this: ROI=(Gain−Cost)/Cost, We cover two additional ROI methods used for real estate investing. These methods can be used whether you pay cash or use a loan to finance the repairs and flip of a property.

The Cost Method

This is the preferred method for properties bought in cash, rental properties, and those more interested in the cash flow and not equity. So if you are more focused on how to rent rather than flip this might be a more ideal ROI formula. So how do you calculate ROI using this method?

ROI= (Equity)/Cost

The costs in this method include all the expenses related to repairs, renovations, and purchases. With this method, any of the expenses involved in renovating and repairing the property are added.

How To Calculate ROI: Out-of-Pocket Method

Many investors use hard money loans, and other loans to finance their investments. This changes how to calculate ROI for your real estate investment. Real estate investors can sometimes make more for their investment because they did not pay in cash.

This is a great method for rental investors, as the annual cash flow can be used to negate the cost of operation. When using this method, investors change how to calculate ROI for their investments.

The following ROI formula is used for these investors.

ROI= Annual Cash Flow / Total investment cash

This differs from the cost method as it only accumulates the cash flow, to the total cost.

Using Your House Flipping Spreadsheet To Estimate Your Repairs

Underestimating the cost of your repairs can cost you. This will eat your bottom line and cut into your overall profit margins and make it harder for you to profit from your flip.

Correctly estimating your repairs will help you determine your profit margins, ARV, and ROI. It is also difficult to properly estimate your repairs!

Labor costs, supplies, and materials are going to be the 3 most important things you track for your repair costs.

Follow the steps below to get an estimate for your repair costs:

- First, compile the total list of materials needed, and record a high and low price estimate for each. Once that’s done, add both columns of numbers to get the total cost for both high and low.

- Then add the two totals, and then divide by two to get the average cost.

- Using this average cost you can compare to national and local averages. This is a great way to determine your repair costs!

Private money lenders in Arizona know that to learn about labor costs, you should talk with other investors and real estate professionals to learn which contractors they use and like. Network with these local service providers to find out what their usual charges are, and team up with those who can do a dependable, quality job at the lowest possible cost to you.

With our home rehab valuator, you can easily record the estimated costs of your repairs, while also tracking the actual costs of your repairs. By keeping an active track of your true costs when you start to renovate your property you can stick to your repair budget. You can get the house flipping spreadsheet for free when you apply today.

How To Find Financing For Your Flip

For those looking to invest in real estate, hard money loans are the best options for new and seasoned investors. These asset-based loans make it easy for investors to get the fast funds they need for their investments. The hard money loan is tied to the after repair value of a property, and can be approved in as little as 2 days!

Be sure to find the best loan for your real estate investment by researching your loan options!b Finding the best hard money loans loan is easy, finding the fastest lender can be tricky with so many options.

To find the best lenders you should look for the following:

- Rates and Terms

- Turnaround Times

- Arizona Hard Money Lender Reviews

- Customer Service

You should always see what the terms and rates will be for your hard money loans as it determines your payment methods. Hard Money lenders should also provide short turnaround times as well! Look for customer reviews to see others’ experiences working with this lender. Reviews can also give insight into the customer service of a company and how they help you get your hard money loans.

Prime Plus Mortgages, the fastest private money lender in Arizona makes it easy for real estate investors to get what they need for investments on their timelines.

Summary

Using a house flipping spreadsheet is a great way to start smarter investments.

When using a house flipping spreadsheet, make sure you know how to properly calculate and track for the following:

- Using Your House Flipping Spreadsheet To Calculate Your ARV

- How To Use Your House Flipping Spreadsheet To Calculate Your ROI

- Using Your House Flipping Spreadsheet To Estimate Your Repairs

- How To Find Financing Your Flip

What is one thing you always track when investing?

Grab your free home rehab valuator for free when you apply today! Apply here!