With the new year only a few weeks away, real estate investors are looking forward to the year ahead with anticipation. How will the real estate investments in the coming year play out? While no one has a crystal ball we’ve compiled feedback from the most noted real estate investment data sources available. Our report includes information on the Phoenix market from this past year, as well what we feel are reliable predictions for 2019. The good news for us and Valley investors is that Phoenix has smoothed to be one of the most robust and stable markets in the country! Fueled with a booming job market delivering noteworthy population growth predictions for the future are moderated by affordability related to both home prices and mortgage interest rates.

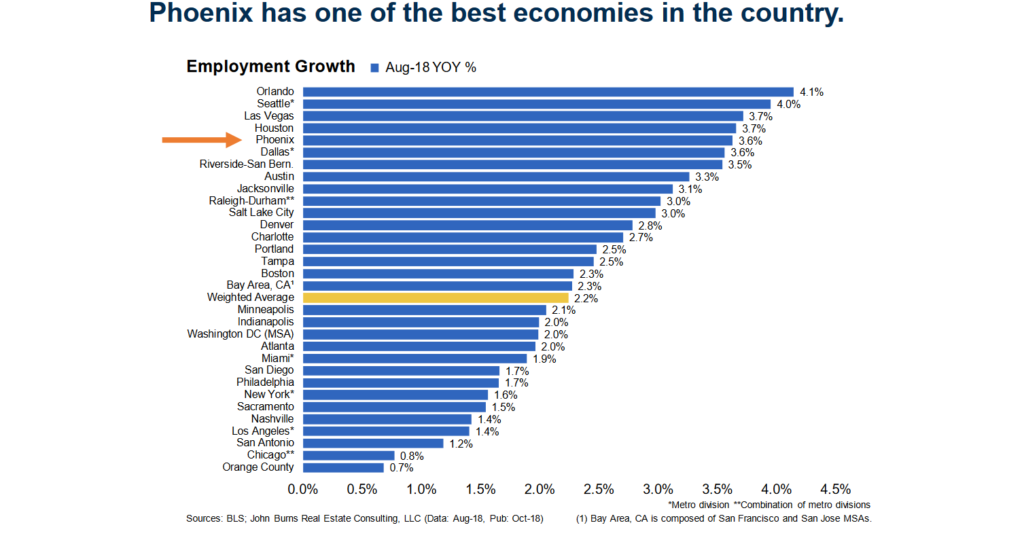

Job Market and Economy

Phoenix has one of the strongest job markets in the country. In fact it was forecasted that an average of 47K additional jobs would be added by the end of 2018, instead, Phoenix performed significantly better than expected, with actual YTD average of 64K jobs being added! One of the top reasons there is such a strong job market in Phoenix is the areas appeal to high wage tech companies. With a strong infrastructure in place, lower cost of living rates, and fewer regulations than Silicon Valley the Phoenix market is now one of the top picks for technology and other high growth verticals.

Heavy Migration to Phoenix

Migration to Phoenix has boomed in the past year! In October 2018, U-haul rentals were priced at $816 per truck, compared to the previous year of $279. Rising rental truck costs infer a higher demand for moving services. Which supports higher turnovers within the city for renters to homeowners, and a higher availability of rental units coming on the market. In fact, migration to Phoenix was a national trend, with top migrations to the area originating from Los Angeles, San Francisco, and Chicago. There were even some international trends. Arrivals from Air Canada to Phoenix jumped from 427,000 arrivals in 2017, to 471,000 in 2018. As more people move to Phoenix the demand for housing continues to remain solid, leaving real estate investors with a continuing seller’s market.

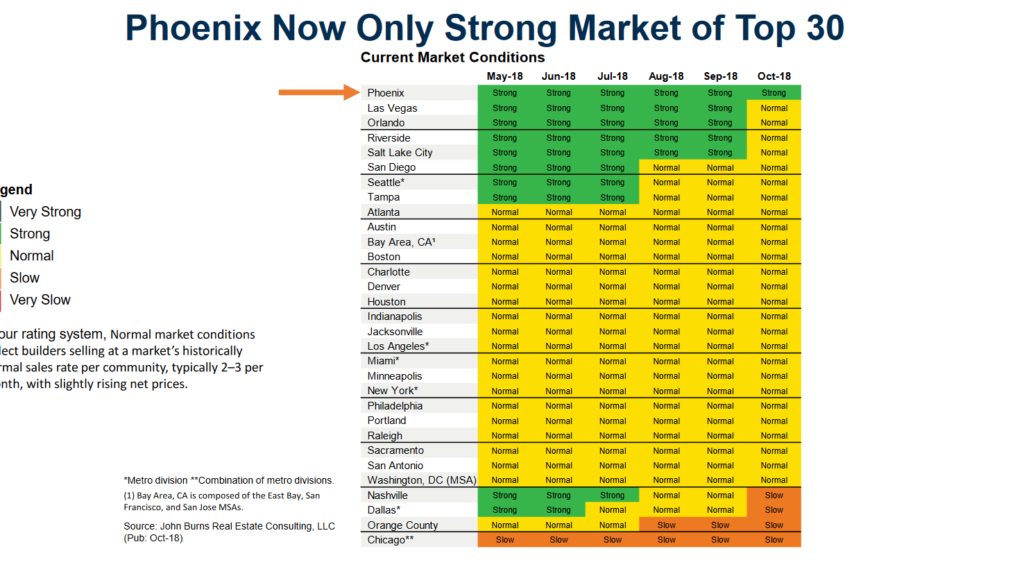

Top Market To Watch In 2019

Phoenix is now the top market to watch. A normal market rating typically means that builders are selling 2-3 homes a month with slowly rising net prices. Phoenix stayed strong, and is the only market ending the 4th Quarter in the strong category, while other markets moved from very strong to normal over the last quarter. Phoenix market trends indicate a 7% increase ($16,000) in median home sales over the past year. The average price per square foot for this same period rose to $162, up from $148. Resale Prices were Forecasted at 6% price appreciation for 2018, while the current YTD is 7-8%. These strong indicators prove that the demand for homes is still on the rise.

Rentals prices and availability rose in the past year as well in accordance with the strong demand from the job market. Average Rental prices in the past year rose from $1,350 per unit to over $1,450 a unit. The number of rentals also increased this past year, with more rentals becoming available to these moving to Phoenix. 2017 saw about 2404 units on the market, while November 2018 saw 3,212 units on the market. Real estate investors in Phoenix with rentals available are doing well in Phoenix’s strong demand-based economy.

Rising Concerns for 2019

While the past year has shown indications for a strong real estate market in the past year, there are some rising data points that have some real estate investors looking a bit suspicious of the market’s strength. The biggest concern for those investing is the affordability, and the possibility of a recession. In fact, 67% of Economists forecast a recession in the next 2 years, but can Phoenix’s strong economy support new home ownership and rising mortgage rates?

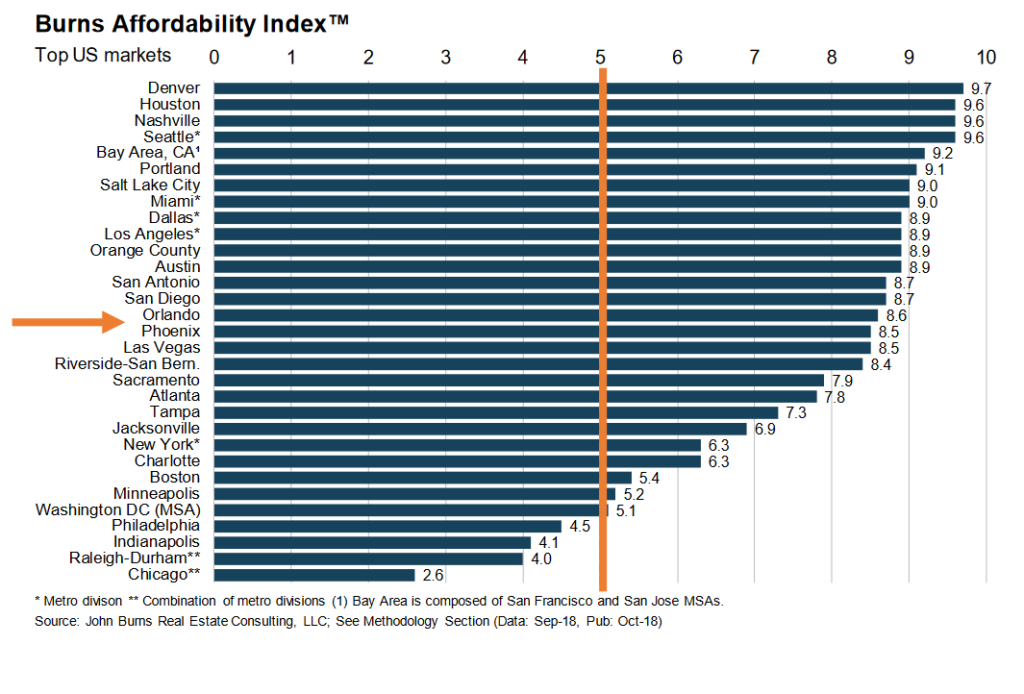

Affordability

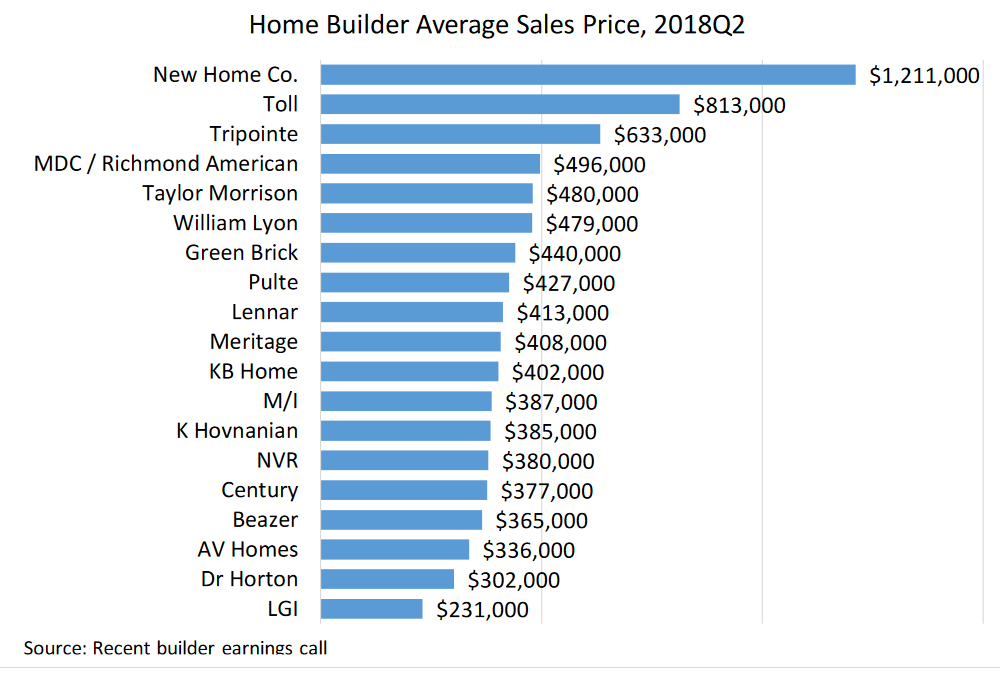

Affordability is the primary risk facing the Phoenix market for both rentals and homeownership. Housing affordability is determined by the share of homes sold in an area that would have been affordable to a family earning the local median income. At today’s 4.6% mortgage rate, home prices are overvalued in many metros. The recent trend in housing affordability has declined as home prices continue to rise faster than wages. Home builders are contributing by not building true entry-level homes. 11 of the 19 public builders in Phoenix now average home prices above $400,000, with a true entry-level house averaging between $150,000 to $250,000 according to the national average.

Home builders aren’t entirely to blame for the affordability crisis. As costs increases are expected to continue rising well into 2019. Builder demand for lots is also on the rise, and as the demand outweighs property availability, will keep land prices high. There also simply aren’t enough laborers in the construction field, so having fully stocked crews is another large issue that builders face. The largest hurdle that builders face in 2019 will, of course, be materials. Inflation and potential tariffs will keep the material cost high, making significant offsite cost reductions for nice single-family homes years away.

Rising Mortgage Rates

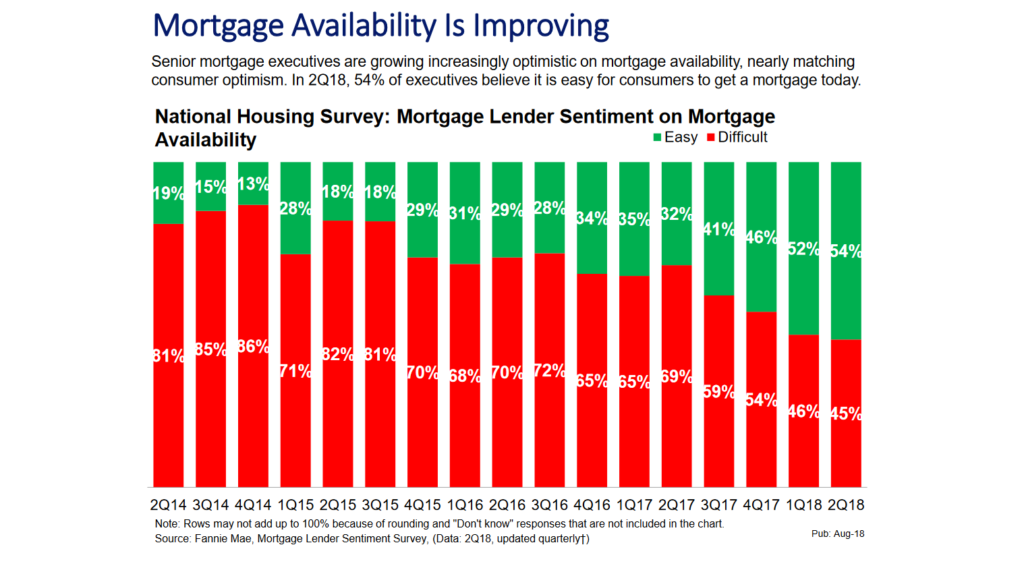

A cause for concern this past year was the rising mortgage rates and how they would affect the real estate market. The forecasted rates were estimated to be somewhere around 4.2% this past year, but we saw rates as high as 4.9%. While this was a large cause for concern for the real estate market, in the past few months we have seen the rates dip back down again, with a rate of 4.6% seen in December.

Despite the rising rates, the real estate market in Phoenix did not seem to falter, with 5,738 houses still being sold in October. Senior mortgage executives are also increasingly optimistic about mortgage availability. 54% of executives believe it is easy for consumers to get a mortgage today, then compared to the year before. The higher rates did not seem to deter determined buyers, and the market still shows great signs of strength and growth as we look to the year ahead.

Phoenix Still In Recovery

Another good sign for Phoenix’s market is that when compared to the pre-recession peak number of jobs, that Phoenix is still considered in recovery. Compared to other top performing areas, such as Austin, which has seen a growth of over 35% in comparison to pre-recession jobs, Phoenix has seen a 9% excess to its workforce. This is great news for Phoenix, as we see that there is plenty of room for the job market, and population, to grow. With new companies moving and expanding in Phoenix, higher earners in Phoenix’s top industry will be looking at higher quality homes.

Key Takeaways:

Strong Economy and Job Market Will Continue

Increasing migration and job growth will only continue as more companies move and expand in Phoenix. Phoenix also has one of the best economies in the country. Phoenix has had strong economic growth of over 3.6% in a single year. Phoenix home sales are up over 6% in the past year.

Consumer Knowledge

Homebuyers have never been so informed, with easy access to home values and home listings available, consumers can feel more confident in their home buying or renting decisions. The home buying process has also been simplified with quick actions, such as online home offers and instant all-cash offers. Homeowners are now looking more to technology features, such as smart homes, as well. Smart home features like ‘Alexa’, or ‘Ring’ technologies are making it easier to monitor your homes remotely easier. Using Google’s Search Data indicates Phoenix Home Sales Will Increase 5% in the Next 3 months.

Rates Affect On Home Sales

Rising rates will slow some real estate markets. Predictions indicate that the higher rates will slow Move-up home sales volumes – an 11% hit to total home sales. However, the Phoenix market has dipped recently and is still in recovery, so we can forecast home sales will stay strong. Mortgage rates may average at 4.5% in 2019, making move- up sales less affordable.

Rental Demand Will Continue to Increase With The Job Market

Investing in rentals is a great way to see an easy and fast return in Phoenix. Owning a rental home is a great investment in Phoenix with a strong consumer and institutional demand.

Lending Availability

Those in the real estate industry now have access to a large variety of lenders. Hard money startups make loans that banks use to offer for a variety of lending purposes, making it easier to acquire properties, and faster than banks can. In fact, many investors looking to have a jump start in Phoenix Real estate market are using hard money loans to fund their flip properties, long-term rental homes, vacation rentals, and even large multi-family units. Hard money lenders in Arizona, such as Prime Plus Mortgages make lending easy for real estate investors, with a quick and hassle-free application process, and same day approval. Learn more about our loan programs here.

Citation

***CAMACHO, CHRIS. 2018 Metro Phoenix Land & Housing Forecast, Land Advisors, 5 Dec. 2018, www.landadvisors.com/pdf/PLAHF2018.1204.pdf.